- Are funeral expenses tax deductible in 2021 how to#

- Are funeral expenses tax deductible in 2021 professional#

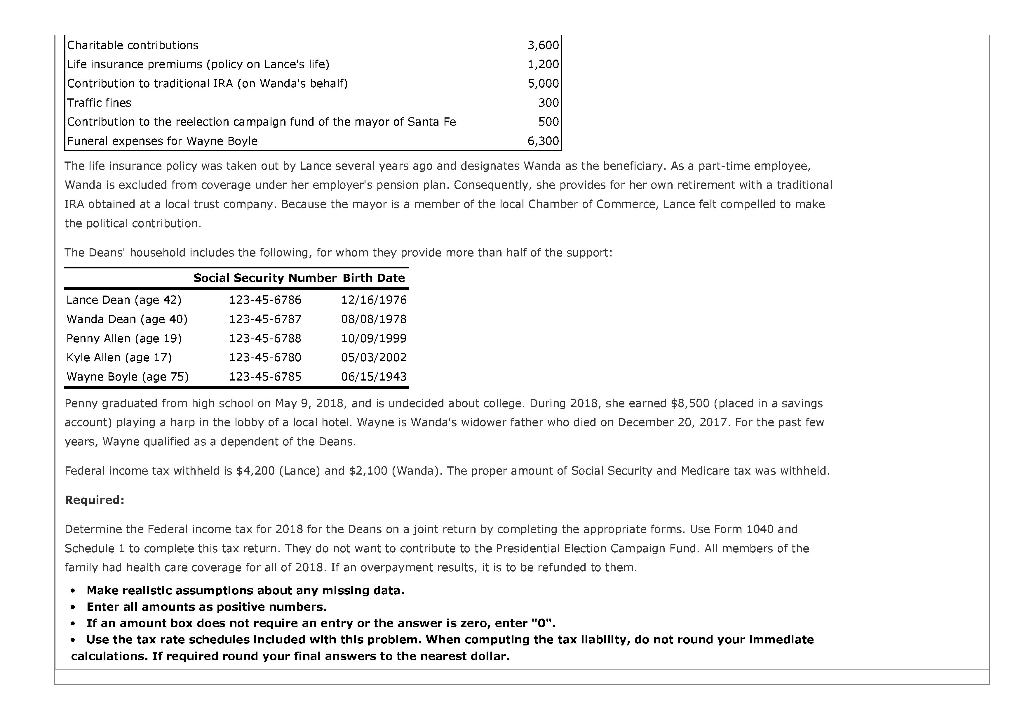

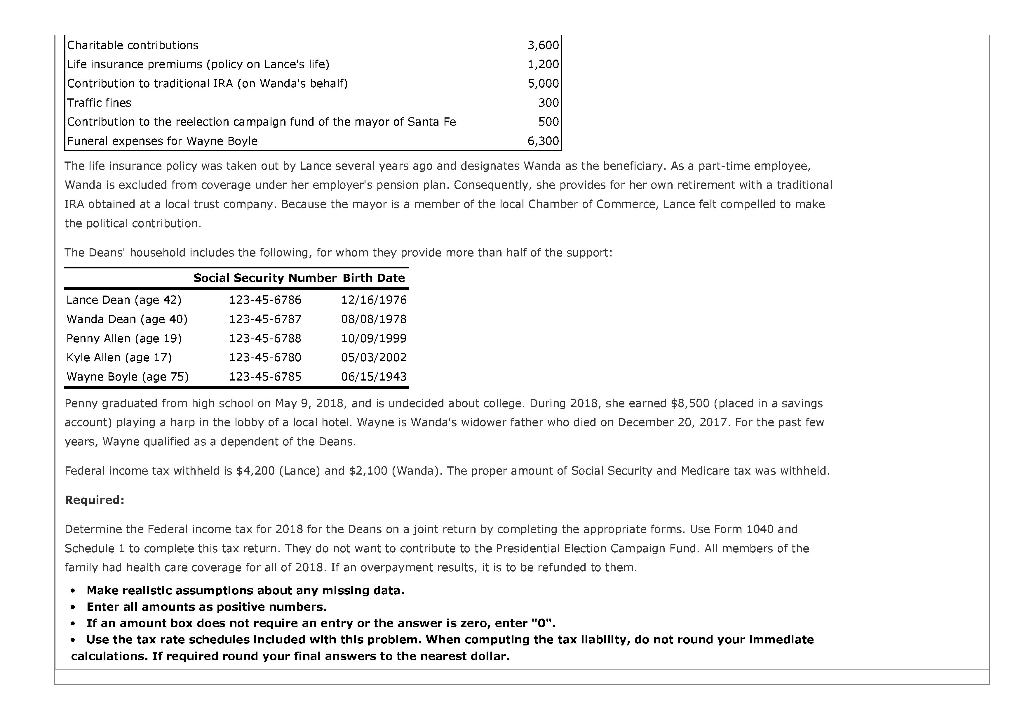

Money in traditional IRAs, 401(k)s, 403(b)s, and annuities is taxed to the heir. Only interest on it from the time you become the owner is taxed. Money you inherit is generally not subject to federal income taxes. Earnings after the date of death are taxable to the beneficiary of the account or to the estate. Only income earned between the beginning of the year and the date of death should be reported on the decedents’ final return. Upon the death of a taxpayer, income is taxed either on the taxpayer's final return, on the return of the beneficiary who acquires the right to receive the income, or on the estate's or a trust's income tax return. Qualified medical costs are those that treat or prevent illnesses and other conditions. Individual taxpayers can claim certain medical expenses on their returns, but funeral expenses aren’t medical costs. The decedent’s final tax return isn’t eligible for any funeral-related tax write-offs.Īre Funeral Expenses the Same as Medical Costs? Estates with lower values may have to file state tax returns, depending on their location.Ĭan Funeral Expenses Be Claimed on a Deceased Person’s Final Tax Return? Estates worth at least $11.58 million must pay federal taxes. Not all estates need to pay taxes, so only those of certain values can claim tax write-offs for funeral and burial costs. Which Estates Can Claim Tax Deductions on Funeral Expenses? However, these forms aren’t used to claim funeral-related tax deductions. Add these total costs to the value of “total funeral expenses.” Write the amount at the bottom of the Schedule J page and on line 14 of page 3.Įstates that earned income are sometimes also required to file income tax forms using IRS Form 1041. These are other costs paid to settle the estate. Itemize your miscellaneous expenses on line 4. These are the costs of executor, attorney, and accountant fees. Add your administration expenses for settling the estate to lines 1 - 3 of Section B on page 17. Use these steps to get your final tax deduction amount: You’ll need to add this number to fees that aren’t related to the funeral. Write the total on the “total funeral expenses” line. These are the costs discussed in the “Which Funeral Expenses Are Tax Deductible?” section of this guide. Enter your itemized funeral costs on line 1 of Section A. Use these steps to claim write-offs for funeral expenses:

Are funeral expenses tax deductible in 2021 professional#

Always consult a tax professional before completing any IRS forms.

Are funeral expenses tax deductible in 2021 how to#

How to Claim Tax Deductions for Funeral ExpensesĮxecutors can claim tax deductions by completing Schedule J on IRS Form 706.

Fees paid by government programs or other grants, such as burial benefits paid by the Veterans Administration (VA) or the Social Security Lump Sum Death Benefit. Costs paid by a final expense insurance policy or other life insurance policy. They’re not eligible for tax deductions by the estate, and individuals can’t claim them on personal tax returns.

Some funeral costs are personal expenses.

Funerals cost an average of about $9,000, so the IRS may not honor every claim for more expensive funeral services and receptions.įuneral Expenses that Aren’t Tax Deductible Note that the IRS may not accept all of your requested write-offs. This way, you won’t run into any problems if you’re audited by the IRS. Keep receipts to prove the estate paid these fees. You can’t claim costs paid by the executor, the next of kin, or a burial or funeral insurance policy. You can deduct expenses paid with estate funds.

Tombstone, gravestone, or other grave marker. Minister, rabbi, or other religious leader eulogy fees. Transportation costs for the deceased and their immediate family members, including hearse and limousine services. Funeral service arrangement costs, including floral and catering services. There are several costs that qualify, including: Only estates can claim tax write-offs for funeral costs, not individuals. Which Funeral Expenses Are Tax Deductible?

0 kommentar(er)

0 kommentar(er)